Web Host Debtor

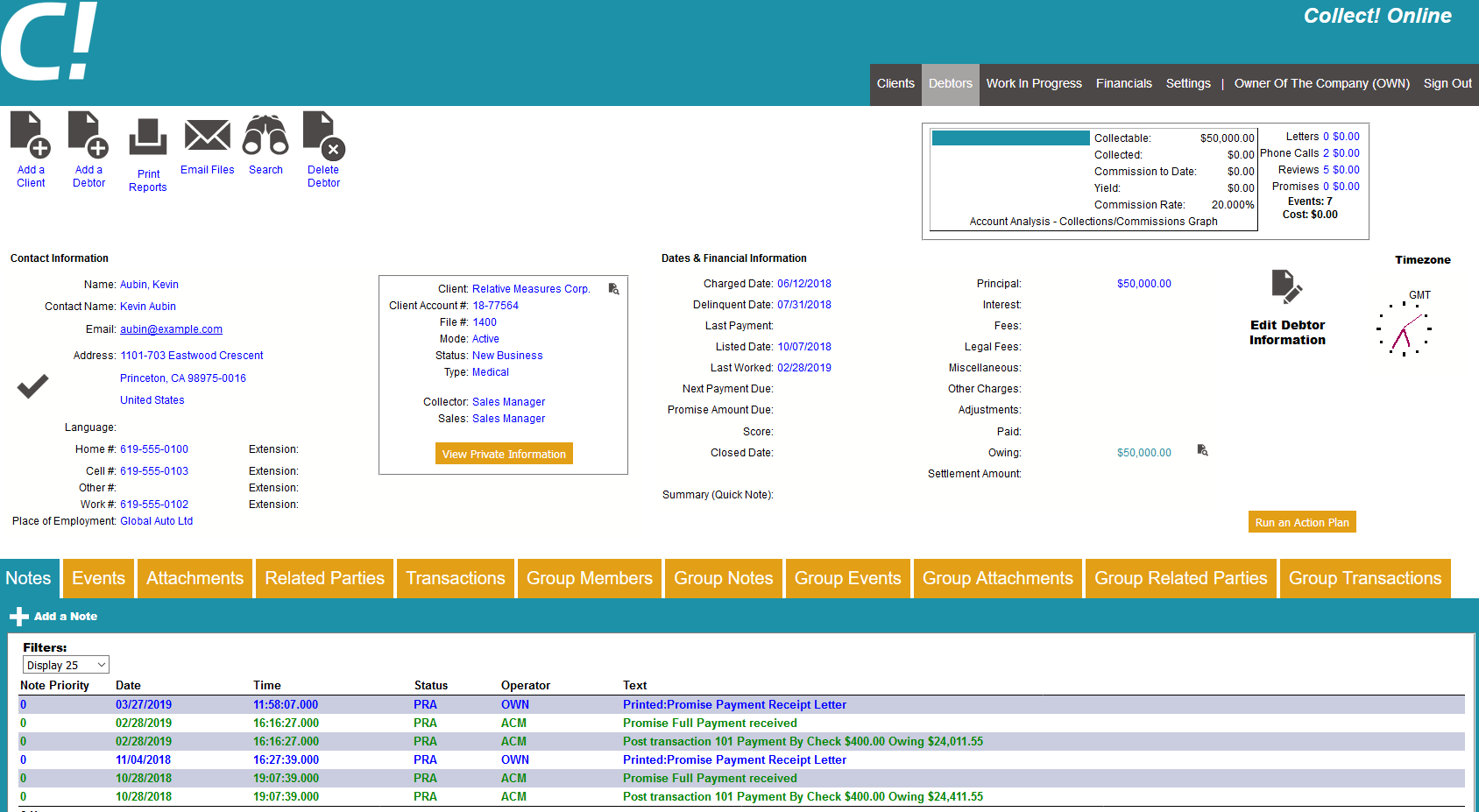

The Debtor form stores all information that you need to work

and manage your accounts. Personal, financial and in-house

management information is displayed on the form. Tabs enable

you to open sub-forms to access various types of related

information, such as contacts scheduled for the debtor,

financial transactions posted, bank information and other

debtor details, cosigners and attachments. When you select

financial fields on the Debtor form, additional financial details

are displayed in summary screens.

To add a new debtor, click the ADD A DEBTOR button in the toolbar.

Fill in the applicable fields on the form.

The Note and Related Party sections are optional.

A description of each of the sections and fields is available below.

Debtor

Collect! uses the information entered in the Debtor form to:

- Help you manage your collectors' workloads

- Perform financial calculations

- Print a broad array of reports

- Keep track of all activity on each account

Information on the Debtor form can be loaded automatically

for each new Debtor that you create. This speeds up data entry

and minimizes errors. First, the settings and details are entered

into the other areas of Collect!. Then they are readily available

when each new Debtor is entered.

File

The File Number of this account is automatically created

by Collect!. It looks at the highest numbered debtor and

adds 1 for numbering a new debtor. File Number is a

UNIQUE identifier for each account, up to 9 digits in

length. You must not have duplicate File Numbers in

your database.

Collect! uses this File Number for several functions, such

as storing Attachment and Data records attached to the

account. It is also sent as the UNIQUE identifier when

processing accounts for credit bureaus, letter service

and 3rd party data exchanges.

This field is INDEXED.

FOR CBR: the File Number must not change

while the account is being reported.

Collect! does allow you to modify the File

Number, if needed. Remember that you can

use up to 9 digits here. Each account must

have a UNIQUE File Number.

Collect! does allow you to modify the File

Number, if needed. Remember that you can

use up to 9 digits here. Each account must

have a UNIQUE File Number.

Client

The Name of the Client is displayed in this field. You can click

on the 'view' icon to view more information related to the client.

Your clients MUST be set up before

you begin to enter debtors.

Your clients MUST be set up before

you begin to enter debtors.

Client Number

This is the Client Number assigned by Collect!.

When you select a Client for the Client field,

the Client Number displays in this field.

You must set up clients before you

begin to enter Debtor information.

You must set up clients before you

begin to enter Debtor information.

Most of the information below is available on the main Debtor view,

but for organizational purposes, we will go through the fields

based on where they appear in the 'Edit Debtor Information' view.

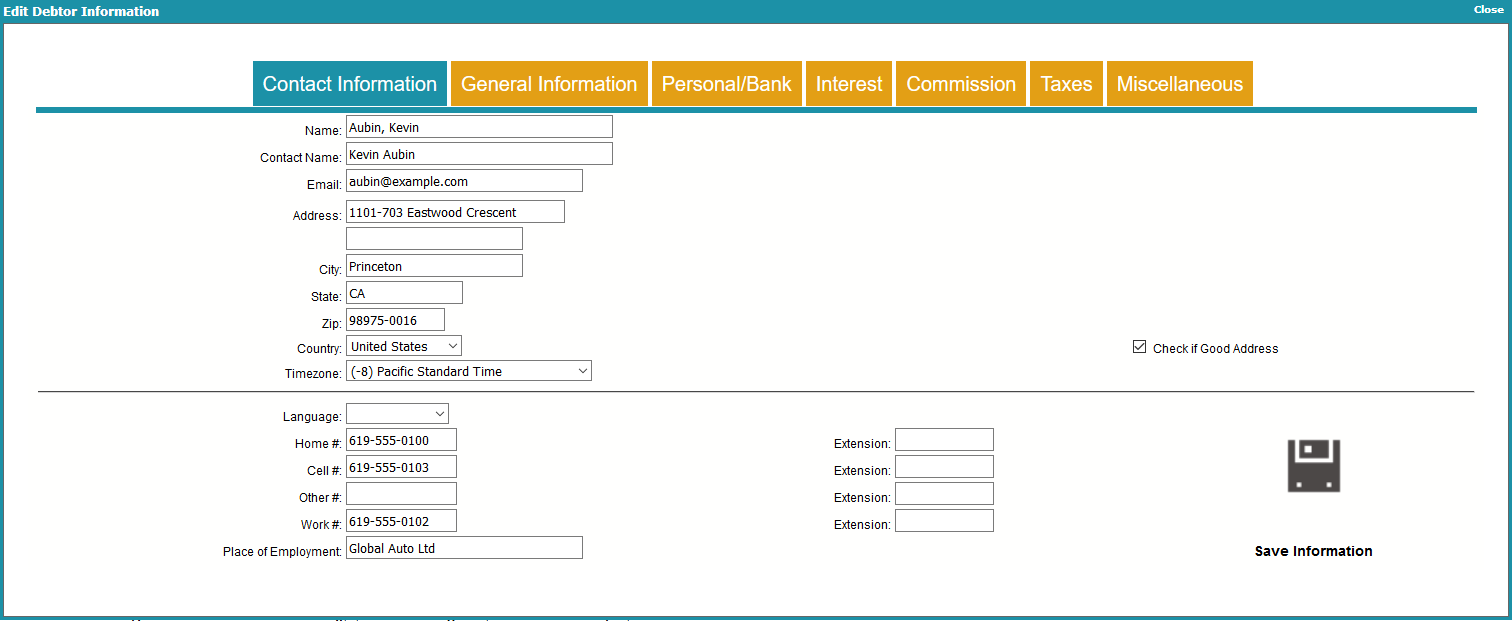

Debtor Contact Information

Name

The Name of the debtor entered as 'Last, First / Middle initial'.

Please ensure your spelling is correct. This field is INDEXED.

If you type a comma in the name, Collect! will split first and

last names automatically and put the result into the Contact

field below. For example, JONES, SAM = Sam Jones.

If you do not place a comma between the last and first name,

Collect! will assume the name is a business name.

FOR CBR: Hyphenate multiple last names,

e.g. 'Van-Deusen, Jack'.

FOR CBR: Please put ONE Debtor name ONLY

in this field. If you have a Cosigner,

use the Cosigner form.

FOR CBR: Don't include Generation titles in the

name here. Use the Generation field.

FOR CBR: When reporting Commercial accounts,

Collect! can detect a business name as long

as there is no comma in the Name. If there

are commas in the business name, please

ensure that you switch ON "Business/Commercial"

in the ECOA designation when setting up this

account for reporting.

Contact

This is the name of the Contact person at the address

or phone number. This field is INDEXED. Unless you enter

a different name manually, Collect! uses the information in

the Debtor Name field to construct the Contact name.

Email

This field is used to enter the debtor's Email

Address. This field is INDEXED. Select

the field icon to open the Send Mail form

where you can compose an email and send it

to this debtor.

Address

This is the Address of the debtor, if it is known. Two lines are

available. If you enter text into the first line, the Print switch

(Address OK) will be set automatically. This will enable printing

notices to this debtor using contact plans and action codes.

When you change an existing debtor Address line, the old

address line will be written automatically to the debtor's Notes.

*** IMPORTANT *** If you ever intend to report to

Credit Bureaus, you must use one of the

following address formats or an error will result.

FOR CBR: There are two acceptable formats:

- Format 1:

- Address = street address

- Addr1 = blank

- City = city

- State = state

- Zip = zip

- Country = country code

- Format 2:

- Address = street address

- Addr1 = suite or apartment number

- City = city

- State = state

- Zip = zip

- Country = country code

Do not include the # symbol in the

apartment number. The Credit Bureau

rejects addresses with the # sign.

Do not include the # symbol in the

apartment number. The Credit Bureau

rejects addresses with the # sign.

Address 2

This is another Address line for the debtor. Use this line to enter

Suite or Apartment number if you intend to report to credit bureaus.

FOR CBR: Do not use the words "Suite", "Apt.",

etc. or the '#' symbol, just enter the

Number of the suite or apartment.

FOR IMPORTING: If you have a data file that combines city, state,

and zip into one field or string (Example: Los

Angeles CA 90210), you can import it into the

Addr 1 field and the import module will separate

the string into the applicable city, state, and

zip fields. In order for this to work, the city,

state, and zip fields can not have any existing

data in the fields.

Check If Good Address

The Print Notice (Address OK) switch controls whether or not

letters are printed to this debtor. If the box contains a check mark,

letters will be printed. If it is blank, letters will NOT be printed for

the debtor. Only set this switch to print (by clicking into the box

to create a check mark), if you have a valid address to send notices

and letters to. Collect! checks the first line of the address. If it

finds an address, it will turn this switch ON automatically by

entering a check mark in it.

FOR CBR: Entering the correct address status

is important if you are reporting to CBR.

*** NOTE If this box is blank or you remove the check mark

from the box by clicking into it, the address fields

in the Debtor form change color. This is to alert the

operator that there is no valid address for this

debtor. This is the first step in skip tracing.

You can fine-tune Address OK functionality for

printing your daily letter batch. Please refer to

Help topic, Required Address Fields for

additional options for validation addresses.

You can fine-tune Address OK functionality for

printing your daily letter batch. Please refer to

Help topic, Required Address Fields for

additional options for validation addresses.

City

Enter the City Name here.

This field is INDEXED.

FOR CBR: truncate the rightmost positions

in this field to 20 characters. Alternatively,

you can use the standard 13-character

U.S. Postal Service city abbreviations.

State

Enter the State Name or Code here.

This field is INDEXED.

FOR CBR: you must enter State Codes in this

field. Refer to your CBR manual for

correct State Codes.

ZIP

Enter the Zip or Postal Code here.

This field is INDEXED.

FOR CBR: the zip or postal code must be entered

and it must be correct. The zip code may

be either 5 or 9 digits for U.S. zip codes,

or 6 digits for Canadian postal codes.

For example: 12345-6789 or 123456789 for U.S.and

X2Y 3Z4 or X2Y3Z4 for Canada.

Country

Enter the Country where the Debtor lives.

This field is INDEXED.

FOR CBR: The Country Code is read from the

Country Code field in Credit Report Details

for the debtor. Collect! uses standard

two-character country abbreviations

specified in the Metro 2 manual.

If you are not doing Credit Bureau Reporting, this field is optional.

Timezone

This field holds a POSITIVE or NEGATIVE integer

indicating the Timezone of this Debtor. Timezones

are standard integer values calculated from GMT

(Greenwich Mean Time). You can use the value in

this field to load contacts in the operator's

work queue according to the account's local time.

Language

This field allows you to track the language that the debtor speaks.

This is a string field.

Home

This is the Home or Personal Telephone Number of the debtor.

This field is INDEXED.

Home Extension

This field is used to enter an Extension to the phone

number if needed. It might also be used to enter an

ID number.

POE#

This is the Work or Business Telephone Number of the debtor.

This field is INDEXED.

Work Extension

This field is used to enter an Extension to the phone

number if needed. It might also be used to enter an

ID number.

Cell

This is the Cellular or other number where you can reach the

debtor. This field is INDEXED.

Cell Extension

This field may be used to enter an Extension

to the phone number if needed. It might also

be used to enter a Cellular ID number.

Other

Use this field for an additional Phone Number.

Other Extension

This field may be used to enter an Extension

to the phone number if needed. It might also

be used to enter an ID number.

Place Of Employment

Place of employment.

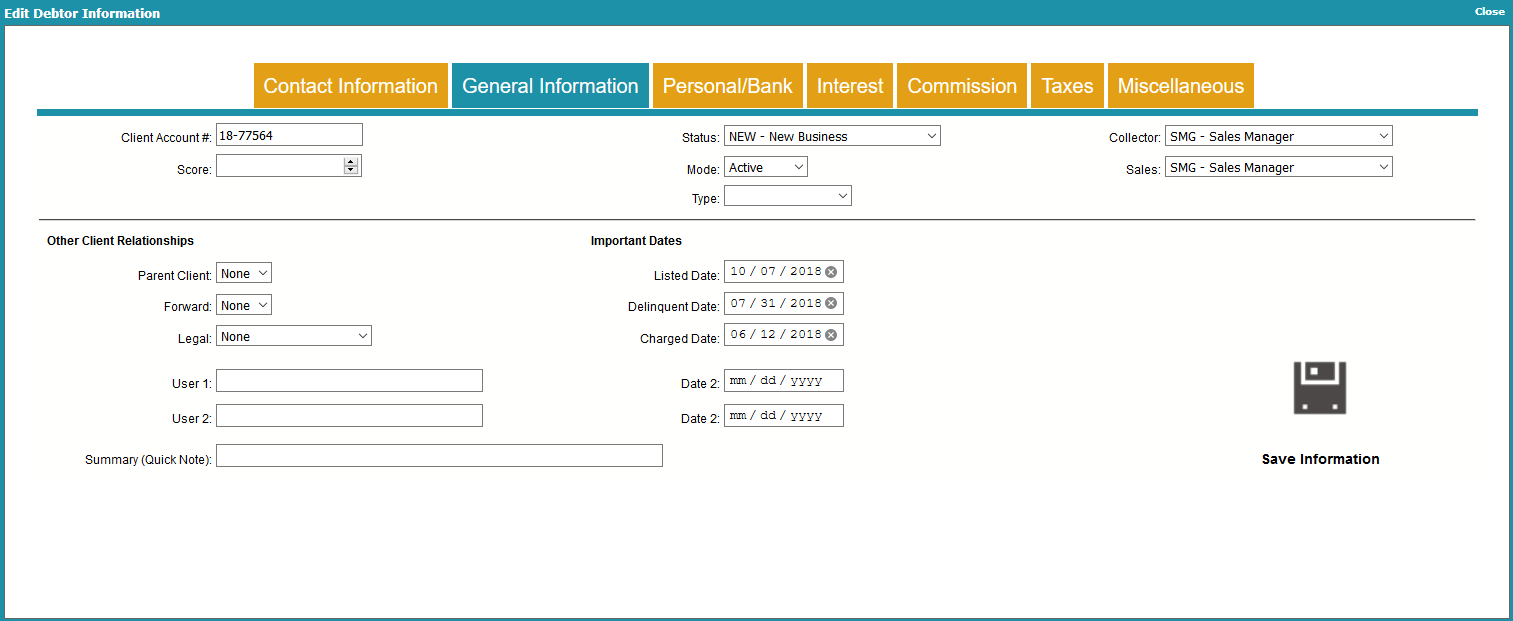

Debtor Contact Information

Client Account #

This is the Reference Number assigned to this debtor by

the client. This is printed on statements to your clients.

This field is INDEXED.

Score

Use this numeric field to store the

Debtor's credit score. This field holds up to

9 digits.

This field can be displayed in the Collector's

WIP List for targeted queuing of High to Low

Score accounts.

Status

This is the Status of the Account.

This field is INDEXED.

Select the arrow to pick from a

list of Debtor Status codes. You can create

your own account status codes.

Mode

This is a very important field. The setting you

choose here affects contact management and

financial calculations. This field is INDEXED.

Select the field or select the arrow to choose

one of the following modes.

Active - activates the account.

Closed - closes the account and deletes all

pending Contacts, UNLESS a Contact has

the switch "Do not autodelete" set. However,

Promises and Transactions will be marked

completed when an account is closed,

regardless of the "Do not autodelete" setting.

Precollect - treats the debtor as 'Closed' but

does not delete Contacts.

Suspend - treats the debtor as 'Closed' but

does not delete Contacts.

Mode And WIP List

Only ACTIVE accounts appear in WIP Lists.

CLOSED or SUSPENDED accounts do not show even

if they have contacts scheduled for the day.

Closed Mode And Interest

Collect! will not let you close a debtor with

accrued interest. You will need to reset the

interest rate to 0% in order to change the mode.

Collect! needs Transaction Type 499, with

the correct settings, to perform the

calculations. If you do not have

Transaction Type 499, you can copy it

from your Demonstration database or

request it from Collect! Member Services.

Collect! needs Transaction Type 499, with

the correct settings, to perform the

calculations. If you do not have

Transaction Type 499, you can copy it

from your Demonstration database or

request it from Collect! Member Services.

Mode And CBR

Mode does not affect credit bureau reporting. As

long as "Report to credit bureau" is switched ON in

the Debtor's Credit Report Details, Collect! will continue

to report this Debtor, no matter what Mode is selected.

Type

This is a free form field. You can define your own types of

debts, or use this field as a sort criteria. This field is INDEXED.

Collector

This is the ID of the Operator assigned to this account.

It is important to fill in this field since many other account

related functions depend on this Operator ID. For instance,

if you are using Account Access Control, this ID may be

used for restricting access to the account. Also, contact

scheduling and timely working of the account often rely

on this ID.

This field is INDEXED.

Sales

This is the ID Code of the Salesperson assigned

to this account. When payments are posted, this ID is

used to determine collector's commission.

This field may also be used to display a Team ID

for commissions or for account access control.

This field is INDEXED.

Parent Client

Click the arrow to view clients that you may select from for

this field with Type Master.

Client ownership is a hierarchical system that

allows you to use the "Owned by client"

in the Client form.

Client ownership is a hierarchical system that

allows you to use the "Owned by client"

in the Client form.

Forward

Click the arrow to view clients to whom you can

forward this account.

Legal

The Legal field gives you a place to put an attorney that

you may want to forward this account to. Click the arrow

to display a list of clients.

You will have to setup your attorney client

first so that it shows up in the list of all clients.

Please refer to the How To Post Attorney Fees section

on the How to Post a Transaction page

for information about setting up an attorney

client.

You will have to setup your attorney client

first so that it shows up in the list of all clients.

Please refer to the How To Post Attorney Fees section

on the How to Post a Transaction page

for information about setting up an attorney

client.

User 1

This field is for your own definition and use.

User 2

This field is for your own definition and use, but it may have

another function if you are reporting to credit bureaus.

If you are reporting to credit bureaus, this

field may contain Original Creditor information.

Please refer to Client Settings for details.

If you are reporting to credit bureaus, this

field may contain Original Creditor information.

Please refer to Client Settings for details.

Summary

This is a single Note Line to Summarize the account status

and add any pertinent vital information.

Charged

This is the date the debt was originally incurred by the debtor.

This date is also used when applying an age-based

commission rate plan to the account. In that case, both Listed

and Charged dates are required to calculate the account age.

FOR CBR: If you do not enter a Delinquency Date, Collect!

automatically uses the Charged Date. For credit

grantors, a switch in the Credit Bureau Setup

form, 'Report charged date', allows the Charged

Date to be used instead of the Debtor's Listed

Date as the 'Date Opened' for CBR reporting

purposes.

Delinquent

This is the date the account went Delinquent. This is usually

the date the account went 31 days past due.

Enter this date manually if you are a collection agency.

FOR CBR: This is the 'Date of Occurrence'. If you do

not enter a Delinquency Date, Collect!

automatically uses the Charged Date.

FOR CBR: If you are a CREDIT GRANTOR and you

have switched ON 'Report as credit grantor'

in the Company Details form, an unmet

promise or a missed payment will show up

as delinquent in the debtor's Delnqnt field.

You must also switch ON 'Calculate

delinquency date' in the Financial Detail

form. The 'Calculate delinquency date'

check box is in effect only when you are

in Credit Grantor mode.

This date affects a person's credit

rating, so use it carefully.

This date affects a person's credit

rating, so use it carefully.

Delinquency Date For Credit Reporting

If you do not fill in a Delinquency Date, the credit

reporting function will use the Charged date, also known

as the 'Date of Last Service' or 'Service Date' and will

issue warnings to you.

You MUST not manufacture dates for accounts reported

to credit bureaus. This date must be provided by client.

The Delinquency Date is defined as the date of the first

delinquency that led to the derogatory status being reported.

The date of delinquency is necessary to purge accounts

from the bureau databases in accordance with the

Fair Credit Reporting Act (FCRA).

The date an account is charged off or placed for collection,

is NOT the Delinquency Date. The Delinquency Date

should be the date the account became 31 days past due.

Listed

This is the Date the debtor was Listed with your agency.

Listed Date is automatically filled in when you create a

new debtor. This field is used in numerous reports and

is important to accurately keep track of your accounts.

This field is INDEXED.

FOR CBR: When reporting to credit bureaus,

this date is used for 'Date Opened'.

For credit grantors, a switch in the

Credit Bureau Setup form, 'Report charged

date', allows the Charged Date to be used

instead of the Debtor's Listed Date as

the 'Date Opened' for CBR reporting purposes.

For credit grantors, a switch in the

Credit Bureau Setup form, 'Report charged

date', allows the Charged Date to be used

instead of the Debtor's Listed Date as

the 'Date Opened' for CBR reporting purposes.

Last Worked

This is the Date the debtor was Last Worked by an

operator.

The Worked Date is filled in, or updated,

automatically only when an operator is physically

working the account by doing one of the actions

listed below.

1. An operator creates or modifies the notes on

the account.

2. An operator runs a contact plan on the account.

The Worked Date is not updated by any other

method. You can not edit this field. It is used in

numerous reports and is important to accurately

keep track of your accounts.

When the Worked Date is the current date, this

field turns red to alert the operator that this

account has already been worked today.

Last Payment

This is the Date of the Last Payment made by the debtor.

Collect! automatically changes that date whenever a

transaction is posted for the debtor.

FOR CBR: When reporting to credit bureaus, this

date is used as the Date of the Last

Consumer Payment.

If the debtor has made a payment to the agency,

the Payment Date is used instead of the Charged

Date above.

You can inhibit Collect! from automatically altering the

date with a switch in the System menu,

Preferences, Plans and Reference Tables,

Payment Posting Options form.

This is a system field and cannot be re-purposed.

Next Payment Due

When a debtor has made a promise to pay, this field shows

the date that the promise is due. If the date is not displayed,

try pressing the Recalc button.

If there is more than one promise recorded for this debtor,

the date of the earliest unmet promise is displayed here.

Promises can be entered into Collect! by

creating a Promise Contact or by creating a

Transaction with no Posted Date. In either

case, Collect! will automatically display the

earliest due date of the debtor's promises in

this field IF "Automatically manage promises"

is switched ON in the Payment Posting Options

form.

Promises can be entered into Collect! by

creating a Promise Contact or by creating a

Transaction with no Posted Date. In either

case, Collect! will automatically display the

earliest due date of the debtor's promises in

this field IF "Automatically manage promises"

is switched ON in the Payment Posting Options

form.

When a promise becomes Past Due, this field is displayed

in red unless the "Report as credit grantor" switch is ON in

the Credit Bureau Setup form. In that case, only, past due

promises are considered delinquent and the date is displayed

in the Delnqnt field on the Debtor form.

You can open the Payment Posting Options

form through the System menu, Preferences,

Plans and Reference Tables.

You can open the Payment Posting Options

form through the System menu, Preferences,

Plans and Reference Tables.

Closed

This field shows the Date When the Account was

Closed. It is visible only when an account is closed.

This field is INDEXED.

When you set the Mode to CLOSED, this

field auto-fills with the current date. This

may be modified as needed for your

purposes.

When you set the Mode to CLOSED, this

field auto-fills with the current date. This

may be modified as needed for your

purposes.

FOR CBR: This date is used for 'Closed Date'.

Date1

This is a date field for your own definition and use.

Date2

This is a date field for your own definition and use.

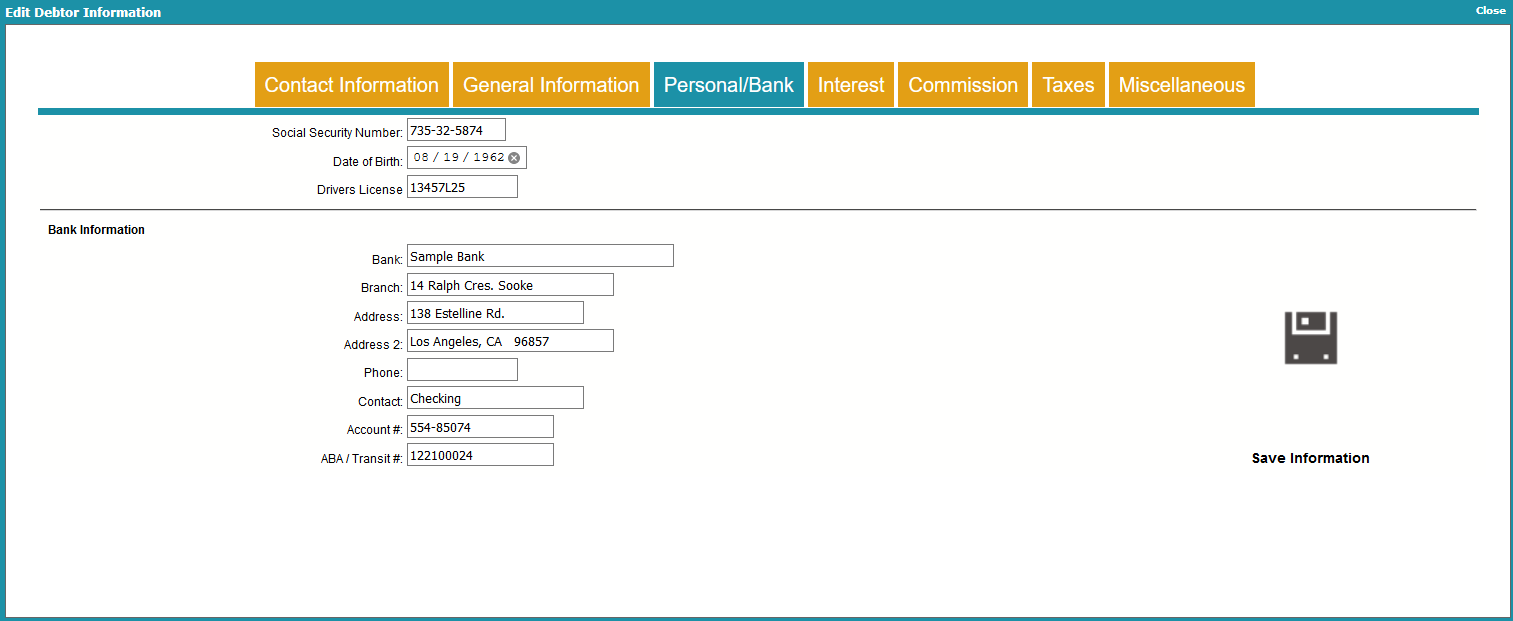

Debtor Personal and Banking Information

Social Security Number

This is the Social Security Number of the Debtor.

If you are NOT reporting to credit bureaus, you

can use this field for other purposes.

This field is INDEXED.

FOR CBR: this field must be filled in.

If SSN is not known, Please check with

your Client/Account provider for the

required information.

Date Of Birth

This is the Debtor's Date of Birth.

This field is INDEXED.

Select the small calendar icon. Select a

Date from the calendar that is displayed. Use the arrows

to scroll through years.

If you are not reporting to credit bureaus, you can use

this field for other purposes. This field is INDEXED.

FOR CBR: Date of Birth must be entered. If DOB is not known,

Please check with your Client/Account provider

for the required information.

Drivers License

Debtor's Driver's License. You can use this

field for other purposes. This field is INDEXED.

Bank

Enter the name of the debtor's bank. This is required if you

are using Take Checks Over The Phone. The name should be

the same as the name on the debtor's actual checks.

Branch

Enter the Branch of the debtor's bank. This is optional. The

information from this field can be pulled when printing

checks taken over the phone for the debtor.

Address

A field available for miscellaneous

details. For check printing, this MUST be the debtor's

bank address first line, i. e. Street address.

Address 2

A field available for miscellaneous

details. For check printing, this MUST be the debtor's

bank address second line, i. e. City, State Zip Code.

Phone

A field available for miscellaneous details.

Contact

A field available for miscellaneous details.

Account

Enter the debtor's Bank Account Number. This is required

if you are using Take Checks Over The Phone.

This field must be either digits or a dash. [ - ] It must be no

more than *** MAXIMUM 12 places *** including any dashes.

This number must match the actual account number on the

debtor's checks.

If you require more than 12 places to enter

the debtor's Bank Account Number, please

phone Comtech for instructions to modify the

report. Otherwise, if you print more than 12

places to the Account Number, it will overwrite

some of the Transit Number.

If you require more than 12 places to enter

the debtor's Bank Account Number, please

phone Comtech for instructions to modify the

report. Otherwise, if you print more than 12

places to the Account Number, it will overwrite

some of the Transit Number.

Please refer to the Help topic How to Take Checks Over The Phone

for information on using the bank fields for checks.

Please refer to the Help topic How to Take Checks Over The Phone

for information on using the bank fields for checks.

Aba Number

Enter the Transit or ABA Number of the debtor's bank. This is

required if you are using Take Checks Over The Phone.

*** IMPORTANT *** This field MUST be 9 places ONLY.

It is digits and can contain a dash [ - ] The TOTAL

places MUST BE 9, including all digits and the dash.

This is also called the Routing Number. It must match the

Transit Number on an actual check from the debtor's bank.

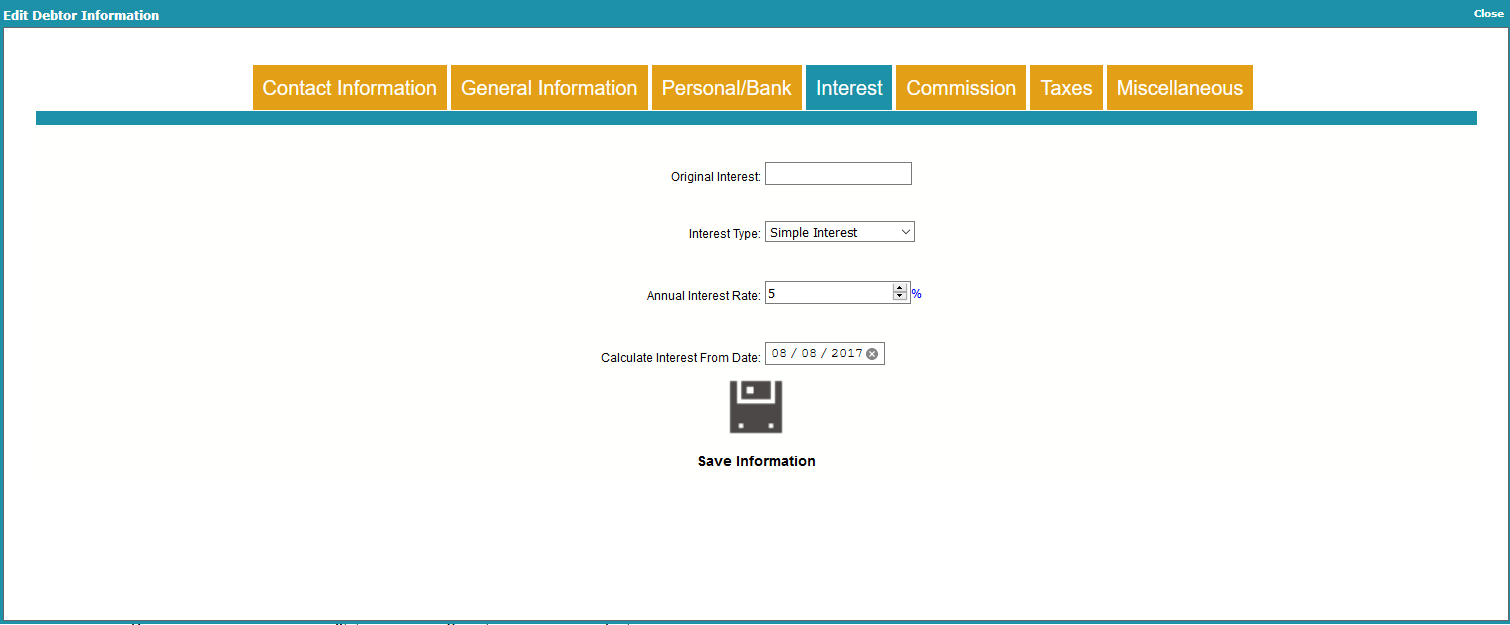

Debtor Interest Information

Original Interest

This is the amount of the interest already charged

on the account at the time the account was listed

with you. The amount is added to the debtor's owing.

It is included in the amount of Total Interest displayed

in the Interest Detail for this debtor. This field is

ignored if you have entered a judgment against

the debtor.

Interest Type

This field allows you to choose the type of interest on

the account. The possible selections are listed below.

No Additional Interest

Select No Additional Interest if you do not want

Collect! to calculate interest on this account.

Simple Interest

When you set this switch Collect! calculates

Simple interest. You must also enter an

Annual interest rate and a Calculate interest

from date. You can choose a 360, 364 or 365

day calculation year.

Notice that the Reset Interest form is accessible

from this setting.

Annual Interest Rate

This is the Annual percent rate at which the account

is charged interest. This rate is divided into appropriate

periods for the interest calculations. This rate is used to

calculate the periodic interest rate and the equivalent

daily rate.

Calculate Interest From Date

In Simple and Revolving Compound Interest calculations,

this is the date from which interest will be calculated. It

is normally the Start Date for the loan. Collect! will

automatically use the debtor's Listed Date as the

calculation start date, unless there is an earlier Charged

Date on the account.

You can adjust the 'Calculate interest from date'

as needed, just make sure that if you have an

Original Principal 196 Transaction on the

account, the Payment Date is not LATER than

the date you want to start calculating interest.

You can adjust the 'Calculate interest from date'

as needed, just make sure that if you have an

Original Principal 196 Transaction on the

account, the Payment Date is not LATER than

the date you want to start calculating interest.

Debtor Commission Information

The Commission Rates form stores the commission rates

you charge your clients for payments received from debtors.

Whenever you post a payment transaction, these settings

are used to calculate commission charges.

Up to four commission rates may be set on the account.

Breakdown settings enable you to apply separate

commission rates to various types of transactions.

Please see the

Commission and Breakdown example here for details.

Use A Commission Rate Plan

The commission that is charged on the debtor's payments will

be calculated based on the rates in the plan that you choose.

When a payment transaction is posted, the dollar

amount of the applicable commission is calculated using the

rate chosen in this field. The actual commission amount is

entered automatically into the transaction's Commission field.

Do not enter both a fixed rate and a rate plan.

Use one or the other only.

Do not enter both a fixed rate and a rate plan.

Use one or the other only.

Rate 1

Enter a percentage here. This is a fixed amount. It is

the portion of the debtor's payment that your agency

charges as a fee for services. When a payment transaction

is posted, the dollar amount of the a

applicable commission is calculated using the percentage

in this field. This amount is entered automatically into

the transaction's Commission field.

Enter a fixed commission amount here OR select a

sliding scale rate plan in the Commission Rate Plan

field.

Do not enter both a fixed rate and a rate

plan. Use one or the other only.

Do not enter both a fixed rate and a rate

plan. Use one or the other only.

Select the type of payment this rate is applied to by

putting a check mark in the appropriate column next

to this field.

Rate 2

You can enter a percentage here if you need to charge

a different commission rate for the breakdown type that

is check marked for Rate 2.

Rate 3

You can enter a percentage here if you need to charge

a different commission rate for the breakdown type that

is check marked for Rate 3.

Rate 4

You can enter a percentage here if you need to charge

a different commission rate for the breakdown type that

is check marked for Rate 4.

Principal

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Principal.

Interest

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Interest.

Fees

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Fees.

Legal Fees

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Legal.

Miscellaneous

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Misc.

Other Charges

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Other.

Bill Commission To Debtor

When this switch is set, the Commission amount is added

to the debtor's Owing.

Normally debtors cannot be charged the

collection expenses. You can only check

the box labeled 'Bill Commission to Debtor'

if you have the legal right in your

jurisdiction to charge the debtor for

incurred collection expenses.

Normally debtors cannot be charged the

collection expenses. You can only check

the box labeled 'Bill Commission to Debtor'

if you have the legal right in your

jurisdiction to charge the debtor for

incurred collection expenses.

Collect! calculates the commission amount and creates

a fee transaction with Transaction Type 399 debiting the

commission amount from the debtor's account. Collect!

uses the information from your Transaction Type 399

settings to determine how to calculate the fees. If this

transaction type is not in the system, you are prompted

to create it in your transaction types.

Please be aware that adding commission to owing alters

the calculation of commission on each payment that is

posted on the account.

When the Add Commission to Owing switch is ON, the

calculation is

commission = payment X (rate/100) / (1.0 + (rate/100))

When the commission is not added to the owing,

the default calculation is

commission = payment X rate/100

Basically, this is the logic:

If a Debtor owes you $100 and your commission rate is

30%, then the total owed is $130. But the commission

they owe you is still $30. So it is no longer 30% of the

total. It is not 30% of $130. It is actually 23.08% of $130.

To find this figure you divide the Commission Owed by

the Total Owed with the Commission added to

it. - $30/$130.

Do not set this switch unless you have a

signed agreement from the debtor on file, or

you are sure the laws in your region permit

you to charge the debtor collection fees.

Do not set this switch unless you have a

signed agreement from the debtor on file, or

you are sure the laws in your region permit

you to charge the debtor collection fees.

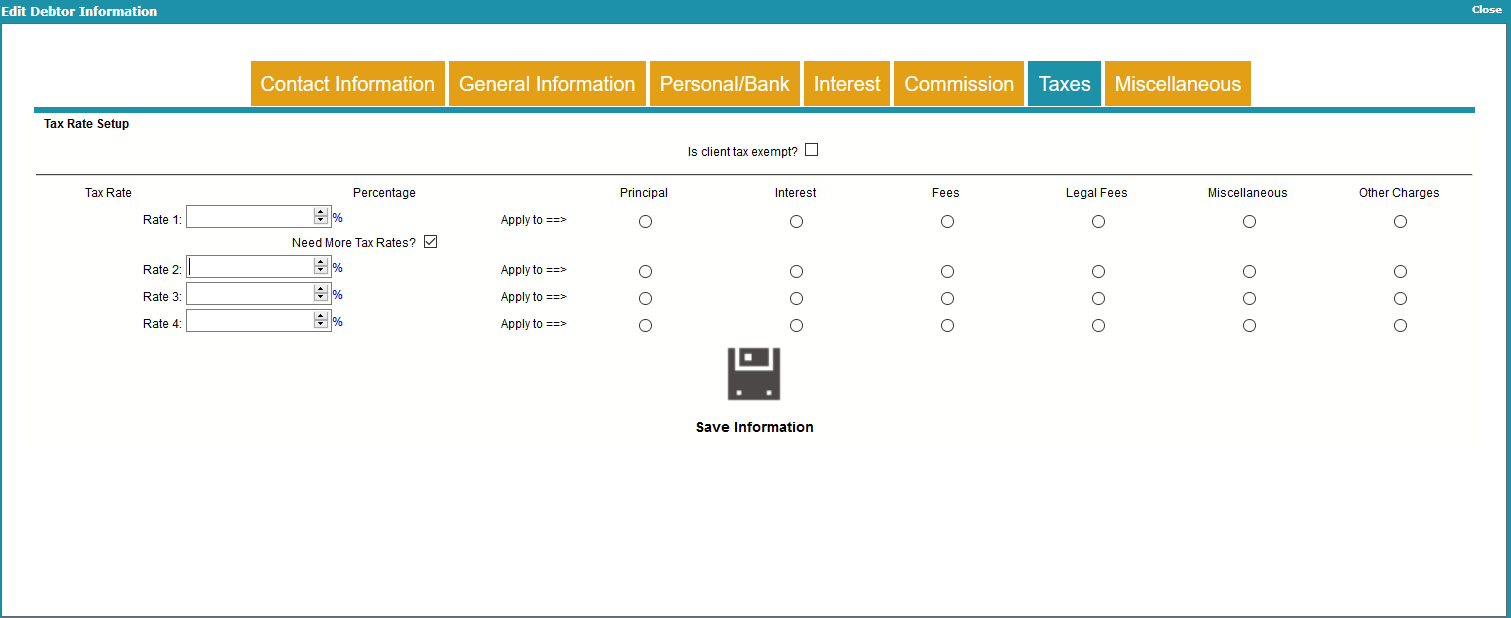

Debtor Tax Information

The Tax form stores your tax rates. Tax is calculated on the

commission you receive from your clients when you post

debtor payments. Whenever you post a payment transaction

with a commission amount, the settings in the Tax form

will be used to calculate any tax charges.

Up to four tax rates may be set on the account.

Breakdown settings enable you to apply separate

tax rates to various types of transactions.

Please see the

Tax and Breakdown example here for details.

Is Client Tax Exempt

This switch turns OFF the calculation of tax on all

transactions for this Debtor. If a Tax Rate has been

set previously, it will not display when a transaction

is posted.

When this switch is ON, tax will not be calculated

even if the "Don't Calculate Tax" switch is not ON

and there is a Tax percentage entered in the Tax

details for the account. Tax will not be calculated if

a transaction is posted with a Tax Rate in the

Transaction Type settings. Whenever a transaction

is posted, tax will not be calculated and the

transaction's Tax field should remain blank.

Rate 1

If you charge tax on commissions that you earn,

enter a percentage tax rate here. (e.g. Enter 7.0

for 7%) This is the tax charged on any commissions

that you receive for debtor payments. This rate is

automatically written into the Tax Rate field for any

transaction posted for this debtor when there is a

commission amount. Tax is calculated on the

commission amount only and is displayed in the

Tax field of the transaction.

This field must contain a value if you are calculating

tax on commissions for this debtor.

When a new debtor is entered, this field is filled

automatically from the Client Settings Tax Rate field.

You can change the rate for this particular debtor to

override the rate used generally for the client.

Select the type of transaction to apply this tax to

by placing a check mark in the appropriate box in

the columns next to this field.

Rate 2

You can enter a percentage here if you need to charge

a different tax rate for the breakdown type that is

check marked for Tax 2.

Rate 3

You can enter a percentage here if you need to charge

a different tax rate for the breakdown type that is

check marked for Tax 3.

Rate 4

You can enter a percentage here if you need to charge

a different tax rate for the breakdown type that is

check marked for Tax 4.

Principal

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Principal.

Interest

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Interest.

Fees

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Fees.

Legal Fees

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Legal.

Miscellaneous

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Misc.

Other Charges

Select a Rate or Rates that you wish you apply to any

portion of the Transaction that goes to Other.

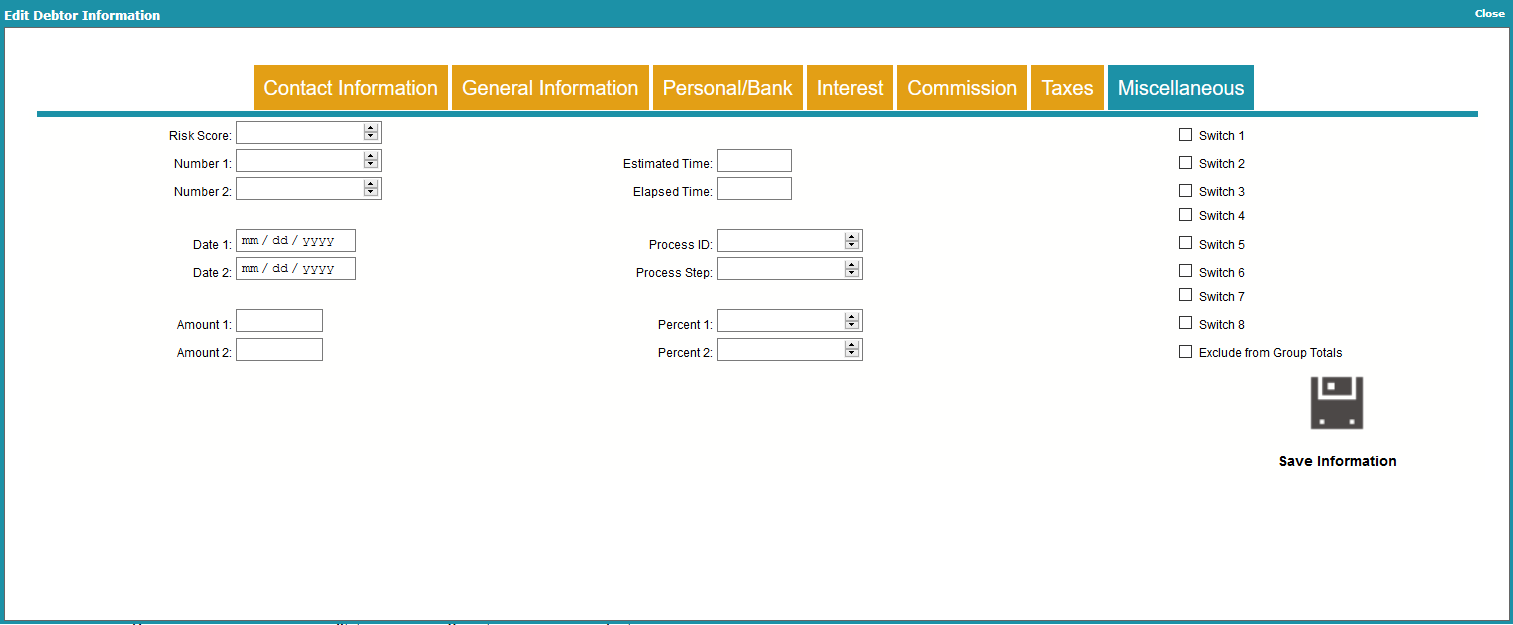

Debtor Miscellaneous Information

The MISC form provides many useful "buckets" where you

can store additional account information in a variety of

data formats. There are several user-defined fields for Numbers,

Dates, Time, Percentage and several ON/OFF Switch fields.

Risk Score

User-defined field to hold a Percent value. This field stores

only whole numbers with no decimal places, no other data

type can be stored in it.

Number 1

User-defined field to store a Number Value. This field stores

only whole numbers, no decimals.

Number 2

User-defined field to store a Number Value. This field stores

only whole numbers, no decimals.

Date 1

User-defined field to hold a Date. This field stores only

dates, no other data type can be stored in it.

Date 2

User-defined field to hold a Date. This field stores only

dates, no other data type can be stored in it.

Amount 1

User-defined field to hold a Currency amount. This field

stores only dollar amounts, no other data type can be

stored in it.

Amount 2

User-defined field to hold a Currency amount. This field

stores only dollar amounts, no other data type can be

stored in it.

Estimated Time

User-defined field to hold a Time value. This field stores

only Time values in the format hh:mm:ss, no other data

type can be stored in it.

Elapsed Time

User-defined field to hold a Time value. This field stores

only Time values in the format hh:mm:ss, no other data

type can be stored in it.

Process ID

User-defined field to store a Number Value. This field stores

only whole numbers, no decimals.

Process Step

User-defined field to store a Number Value. This field stores

only whole numbers, no decimals.

Percent 1

User-defined field to hold a Percent value. This field stores

only floating point numbers with up to 4 decimal places, no

other data type can be stored in it.

Percent 2

User-defined field to hold a Percent value. This field stores

only floating point numbers with up to 4 decimal places, no

other data type can be stored in it.

Switch 1

User-defined field to hold an ON/OFF value. Switch this

ON with a check mark.

Switch 2

User-defined field to hold an ON/OFF value. Switch this

ON with a check mark.

Switch 3

User-defined field to hold an ON/OFF value. Switch this

ON with a check mark.

Switch 4

User-defined field to hold an ON/OFF value. Switch this

ON with a check mark.

Switch 5

User-defined field to hold an ON/OFF value. Switch this

ON with a check mark.

Switch 6

User-defined field to hold an ON/OFF value. Switch this

ON with a check mark.

Switch 7

User-defined field to hold an ON/OFF value. Switch this

ON with a check mark.

Switch 8

User-defined field to hold an ON/OFF value. Switch this

ON with a check mark.

Principal

This is the amount of the Original Debt, or the sum of

all transactions posted to the Principal account. (This

means Principal is dotted in the transaction 'Account'

column.) Information is not entered in this field directly.

Interest

This field displays the Total Interest for this account. This

is the sum of Original Interest and all Accrued Interest

on this account.

Fees

This field is a summary of all Fee transactions belonging

to this debtor.

Legal Fees

This field is a summary of all Legal Fee transactions belonging

to this debtor.

Miscellaneous

This field is a summary of all Misc transactions belonging

to this debtor.

Other Charges

This field is a summary of all Other transactions belonging

to this debtor.

Adjustments

This field is the sum of all Adjustment transactions

belonging to this debtor.

Paid

This is the Amount Paid by the debtor. This can be a

negative number if there are charges incurred on

the account.

Owing

This is the total amount Owing, the remaining balance

outstanding on this account.

Click into this field to open the Debtor Financial Summary

This form shows all the charges and payment details for the

debtor's account, including total charges, total payments

and total owing amounts for Principal, Interest and Fees.

Settle

This field indicates an optional settlement amount for this debtor.

Run An Action Plan

Enter a Contact Plan to run on this account.

Account Details

This area of the Debtor form contains tabs to sub-lists of

related Debtor information. The areas that may be

accessed are as follows.

* Notes

* Events

* Attachments

* Related Parties

* Transactions

* Group Members

Each of these sub-forms allow you to view records

related to this account and add new ones. If the tab is

displayed as ORANGE that means there are records in

that area.

Notes

Select the NOTES tab to view Notes for this account

or add new ones. Today's date, the current time,

the status code, and the operator ID

are inserted automatically on the first line of text that

you type.

To edit a note line, click on the note line.

To add a new note line, click ADD A NOTE.

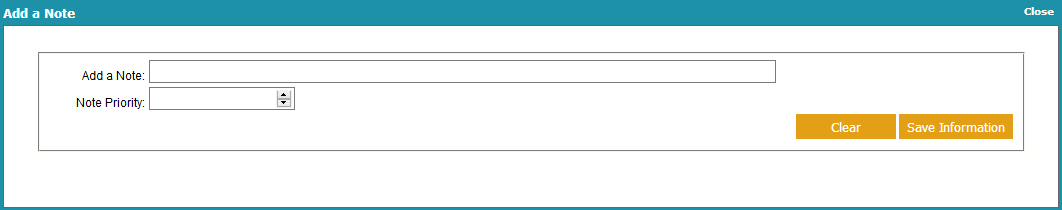

The Add a Note text box is the text associated with the note line.

The priority will set a sort order for the note. Notes are sorted in

descending order on priority, date, then time.

Add a Note Line

Events

Select the EVENTS tab to view events scheduled

for this account. This links to all events made for this

debtor. You may select an existing event or create

a new one.

To edit an event, click on the event.

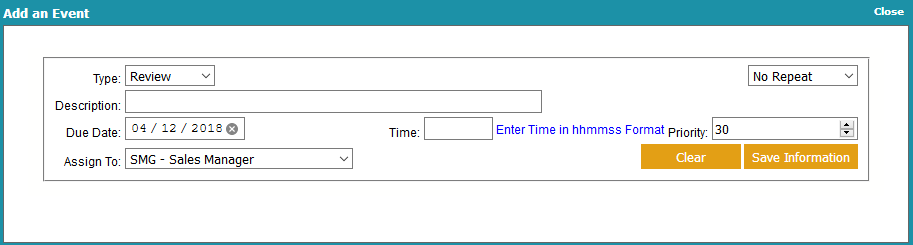

To add a new event, click ADD AN EVENT.

Select the type of event that you want to create:

* Review - general review event

* Phone - indicates a phone action

* Other - miscellaneous event type

* Promise - indicates that money is expected to be received

* Letter - schedule a letter

* Action Plan - schedule an action plan

If promised is selected, the Amount field will be visible to enter the

expected amount of the payment.

Fill in the repeat field if you want the event to repeat. This is

generally used for promises, letters, or action plans.

Fill in a description for the Event. If Phone, Letter, or Action Plan

is selected, this field will be replaced with a drop down list for

the applicable event type.

Fill in the Due Date for the event.

If the time is filled in, Collect! will popup a notice in the

Work in Progress at the time the event is due to be worked.

Fill in the priority of the event.

Assign the event to an operator.

Add an Event

Attachments

Select the ATTACHMENTS tab to view Attachments

stored for this account. You may view existing attachments

or create a new one.

To edit an attachment, click on the attachment.

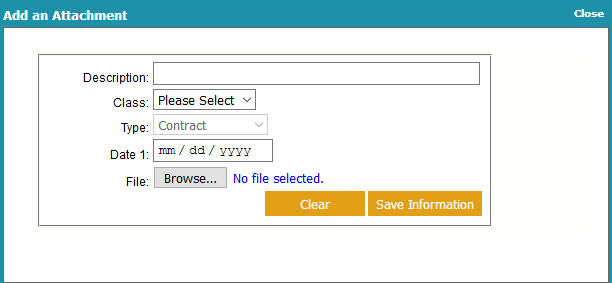

To add a new attachment, click ADD AN ATTACHMENT.

Fill in a description for the attachment.

Select the class of contact that you want to create.

Once the attachment is saved, there will be more options

available associated with the type.

Fill in a Date for the attachment. This is optional.

Browse to a file to be associated with the attachment.

This needs to be done here as once the attachment record

is created, a file cannot be associated with it later.

Add an Attachment

Related Parties

Select the COSIGNERS tab to view the list of all related

parties assigned to this account, such as Attorney, Employer,

Spouse, Bank and others. You may view an existing

Debtor Cosigner or enter a new one.

To edit a related party, click on the related party.

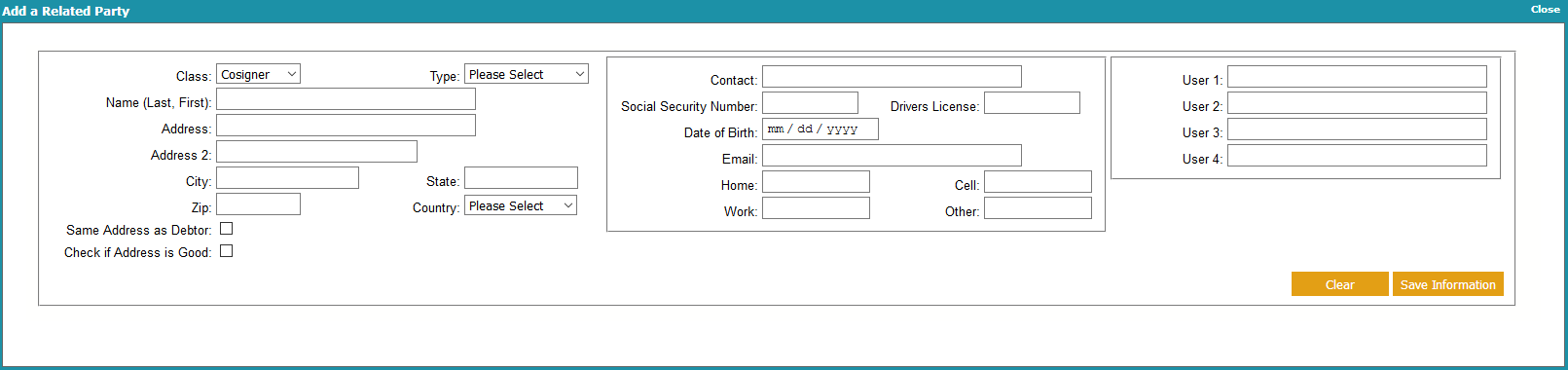

To add a new related party, click ADD A RELATED PARTY.

Fill in the Class. Cosigners are typically other parties that are also

responsible for the debt. Use Other or Contact for references or

people who are associated with the debtor, but not responsible for it.

Fill in the remaining information.

Add a Related Party

Transactions

Select the TRANSACTIONS tab to view transactions

posted to this account. You may select an existing

Transaction or create a new one. This links to any

payments, promises or other related transactions

regarding this debtor.

You must set up transaction types

before you can post transactions.

You must set up transaction types

before you can post transactions.

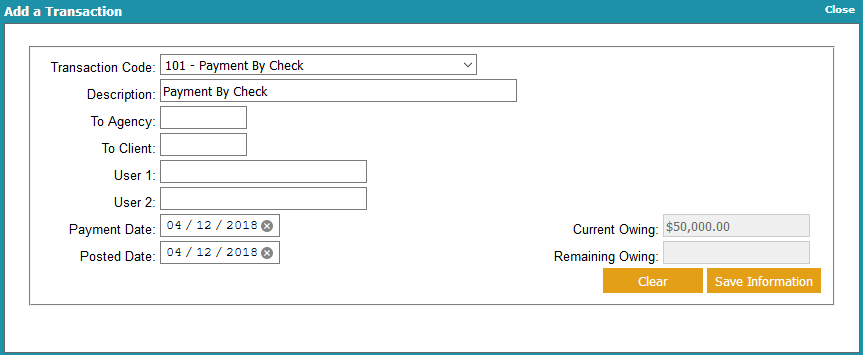

To edit a transaction, click on the transaction.

To add a new transaction, click ADD A TRANSACTION.

Fill in the transaction code associated with the transaction.

The description will auto-fill based on the Transaction Code,

but you can overwrite the description with your own.

Fill in either the TO AGENCY or the TO CLIENT with the amount

of the transaction. To Agency means that the agency received

the funds. To Client means that the client received the funds.

Filling in the correct field is important for month-end billing.

Filling in the correct field is important for month-end billing.

The user 1 and user 2 fields are available for storing extra information

like check numbers.

Fill in the Payment Date. This is the date the system uses for calculating

interest and updating the debtor owing.

Fill in the Posted Date. This is the date the system uses for when generating

client statements.

Add a Transaction

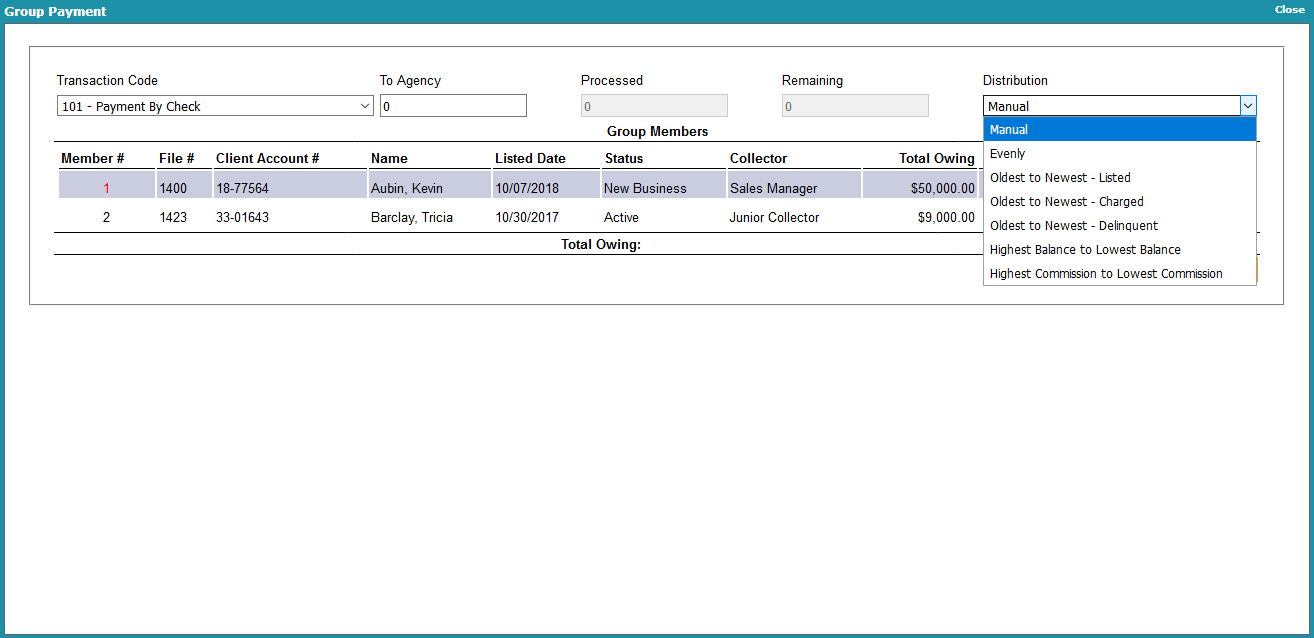

The Group Payment section allows you to split a payment across several group members.

To add a new group payment, click ADD A GROUP PAYMENT.

Fill in the transaction code associated with the transaction.

Fill in the amount that the agency received.

This feature currently does not support payments made directly to the Client.

This feature currently does not support payments made directly to the Client.

Fill in the distribution:

* Manual - check the box next to the accounts you want to pay and fill in the amount

* Evenly - divides the payment amount evenly among the accounts to a maximum of the

debtor's owing amount.

* Oldest to Newest - pays the oldest account first, based on the selected date

* Highest Balance to Lowest Balance - pays the highest balance first

* Highest Commission to Lowest Commission - pays the highest commission rate first

Add a Group Payment

Group Members

Select the GROUP tab to view the list of Group Members

in this account's Group. This will only display if a Group ID

and Member number are associated with this debtor.

Collect! uses account matching based on Name, Social, DOB, Home Phone, and Address

to suggest groupings. If a match is available, you will see a button below the

'Run an Action Plan' button called ADD TO GROUP.

If you click the button, you will see a list of suggested groups that already '

exist, grouped by client.

To add the debtor to a group, select a group and click add.

To remove a debtor from the group, to to this tab and click REMOVE FROM GROUP.

Group Member

If this debtor is grouped, it will be assigned a

sequential number based on the order in which it

was added to the group.

|

Was this page helpful? Do you have any comments on this document? Can we make it better? If so how may we improve this page.

Please click this link to send us your comments: helpinfo@collect.org